Warning Signs that You Need an AP Automation Solution

Technology is getting smarter—integrating itself into ERP platforms without needing people to intervene. Instead of “being the app,” your people will be focused on “using the app” to give business leaders the information they need to make smarter, faster decisions.Technology is getting smarter—integrating itself into ERP platforms without needing people to intervene. Instead of “being the app,” your people will be focused on “using the app” to give business leaders the information they need to make smarter, faster decisions.

Deloitte

Crunch Time, Finance 2025

The warning signs that you need an AP automation solution are there. It’s possible they have not been fully assimilated and distilled into an approved IT initiative. However, it should be, and for several very compelling reasons. AP automation solutions deliver an exceptionally high return on investment and can be delivered in just a few months. Moreover, they allow your business to scale profitably and free up skilled resources for higher value projects.

A Growing Business

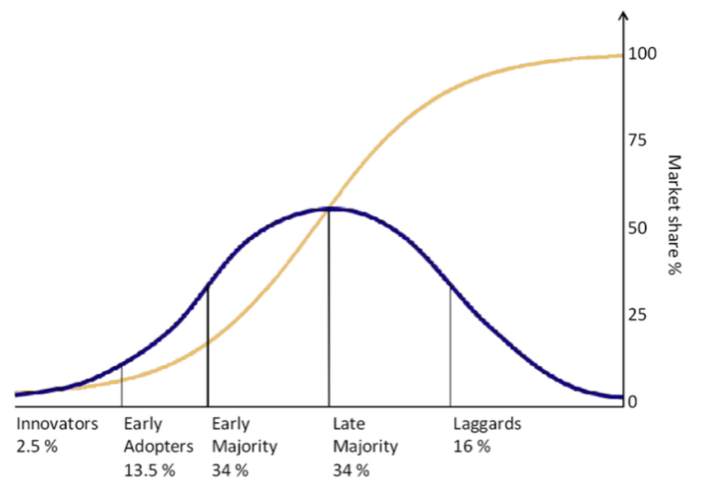

Growth is often associated with new products, new markets, new customers, and new suppliers. This puts enormous pressure on the underlying systems and business processes that support the user community. Forward-leaning IT professionals understand and anticipate the downstream implications of growth by proactively planning and prioritizing new IT initiatives. In particular, greater efficiency and improved decision making are driving transformation initiatives in the Finance department. It is the nexus of business growth. Deloitte predicts that “Traditional processes—and the silos around them—will disappear as the focus of Finance shifts to design, configuration, and maintenance of systems. Finance will excel in translating business practices and governance models into automated processes.” The imperative for IT to lead this move to automated processes is clear.

Margin Pressure

The dual mandate from senior leadership is more growth and higher operating margins. Because of the second imperative, manual business processes are now high on the list for automation. On average, it takes 14.2 minutes to process an invoice manually. By leveraging high fidelity OCR, native integration with ERP systems, and scalable cloud architectures, AP automation solutions can cut the average processing time to 5.0 minutes or less. Emerging technologies like AI, machine learning, and robotic process automation will further improve AP automation in the coming years, moving companies closer and closer to the promise of truly touchless processing.

End User Demands

Outside the workplace, end users are exposed to increasingly more sophisticated applications every day. They carry those expectations to the workplace and expect—indeed, demand—applications that enable them to focus on higher value tasks. However, the best candidates for these roles are often locked into rote data entry roles with very high turnover. AP automation creates the opportunity to lift them out the monotony of AP processing and do their best work: conducting investigations, analyzing performance, and engaging in cross-functional collaboration other departments.