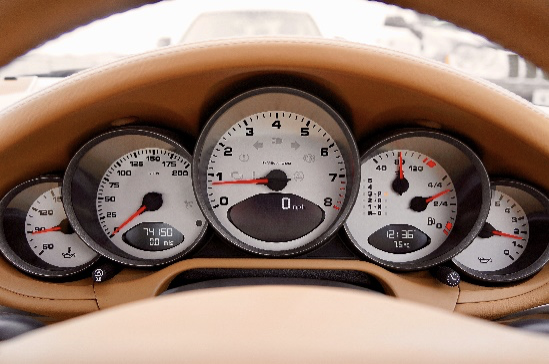

Now that training is complete and a rule set has been preliminarily defined, it’s time to define a set of metrics to instrument touchless processing. By “instrument” I mean “manage.” Think of an instrument panel on a dashboard, with various metrics that indicate how well the process is working and where an AP Manager should focus his/her attention.

The process of defining and refining rules is necessarily iterative. If tolerances are set too low, every invoice becomes an exception. Too high, and you risk compromising the integrity of the approval process. Metrics are required to tune and manage the process. As a wise professor I worked with once said, “If you can’t measure it, you can’t manage it.”

What metrics should be included on the instrument panel? Well, it depends based on the organization and the rule set. Generally speaking, metrics should include the following:

Get Started

Get Started